Millions recently filed their federal income tax returns and now await their Internal Revenue Service refunds. Many people use this time to reassess goals and take responsible advantage of that check.

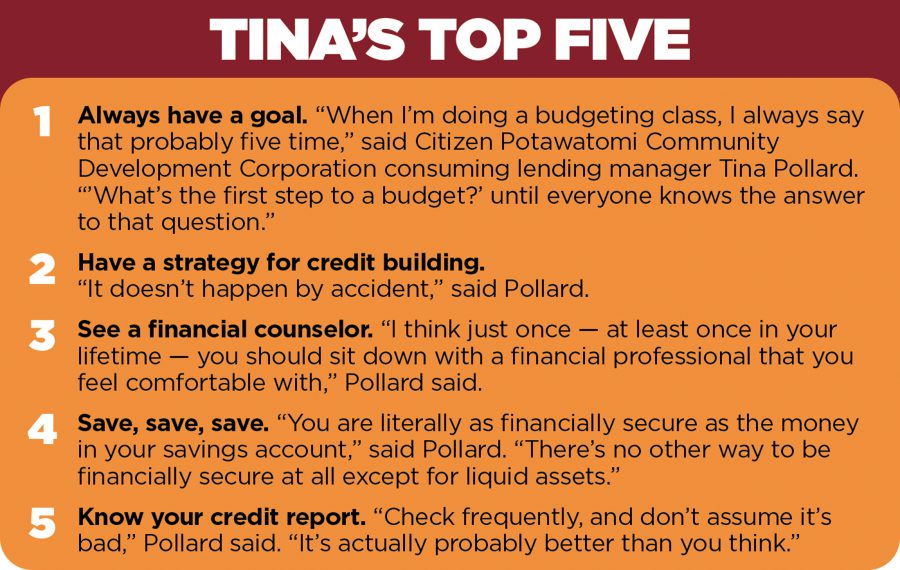

Tina Pollard is consumer lending manager at Citizen Potawatomi Community Development Corporation and one of three certified credit counselors on staff. During a recent interview with the Hownikan, Pollard outlined some common misconceptions about debt, tips for improving personal finances and the importance of budgeting.

CPCDC offers loan and auto loan programs for eligible employees and credit counseling to Tribal members and members of their households, among other services.

Ties between credit and debt

“What I always say with my clients is the number-one thing is you have to figure out where you’re going,” she said.

People want to know how to raise their credit scores immediately. Pollard said credit scores are easy to harm but tough to improve. Focusing on the desired results helps build a roadmap to achieving a better score. Popular goals include home ownership, retirement and no loan payments.

“Everything is a balance — a very delicate balance between being debt-free and having a little bit of debt, and not getting overwhelmed with it,” Pollard said.

Not owing anything seems like the best possible goal; however, managing some debt builds a good credit score. Paying things off early could cut an individual’s credit history short. Pollard says credit cards can be valuable when used correctly.

“You can continue to charge one little thing, pay off every single month until the day you die,” she said. “That’s how you get the decades’ worth of history.”

Pollard helps clients rebuild trust in themselves following irresponsibility with cash and credit cards. Few want to accept the possibility of error.

“Yes; you went through that. That was 20 years ago. Now, you are mature enough to handle holding a credit card. You know how to use it. You know what will happen if you do not use it responsibly,” she said. “So, just trying to talk themselves into trusting themselves sometimes is difficult.”

Budgeting

“Spend less than you can afford,” Pollard said. “In a nutshell, that’s everything, and you have to purposefully do that. We can always find a better place or something more fun to do with our money, but saving is a very deliberate action.”

During sessions, Pollard stresses the importance of developing a savings plan and liquid assets — easily accessed cash. Healthy portfolios include a 401(k), but little compares to access to a healthy, secure savings account, she said.

Effective budgets consider daily expenses, plan for impulse purchases and set aside a realistic amount of cash to spend weekly.

“Instant gratification is expensive, and if they can remember, impulse buys are expensive,” she said. “It costs $2-3 to buy a bottle of water. It costs $3-4 to buy a case of water. So, if you buy it at the front of the store when it’s cold, you’re going to pay as much as one case.”

Pollard also encourages planning more than a month at a time. Periodic expenses such as new tires, insurance premiums and veterinary costs can spiral into an unintended cycle.

She advises clients against payday and signature loans as a way to pay for them.

Tax refunds

Pollard emphasizes thinking in the long term when it comes to tax returns as well as saving a portion of it.

“A lot of people will put new carpet in their house, and that doesn’t really get you ahead,” Pollard said. “That defeats the purpose of getting this large sum of money. The large sum of money is to help you get ahead.”

People tend to get in a cycle of borrowing throughout the year and recouping everything at tax time with their refund. When deciding what to do with it, paying ahead on bills and line items such as insurance is preferable to settling obligations.

“If you spend it all, it is not available to you anymore, and if you start to spend next year’s tax return before you get it — that’s not a good thing,” she said. “Also do not pay for refund anticipation loans. Those are expensive, and they have a lot of hidden costs.”

CPCDC offers financial counseling to Tribal members — in person near Tribal headquarters and over the phone for those across the country.

“My favorite part of my job is the counseling part,” Pollard said. “You can help them reduce their monthly bills. You can help them start to build that nest egg.”

Read a complete list of CPCDC services at cpcdc.org.